↩️ This article is designed for Australian accounting professionals, and is part of our mega-guide on SMSF crypto compliance.

SMSF crypto compliance requirements

The main requirement for SMSF crypto compliance is to ensure it complies with all super laws contained in the Superannuation Industry (Supervision) Act 1993 (SISA) and the Superannuation Industry (Supervision) Regulations 1994 (SISR). Combined, these are commonly referred to as SIS Act.

The ATO has strict enforcement on SMSF compliance, and failure to comply with the regulation can result in penalties or fines.

SMSF Financial Statements

SMSFs in Australia are required by law to prepare annual financial statements. These statements provide important information about the fund's financial position, performance, and compliance with regulatory requirements.

Accounting and financial reporting by SMSFs are governed by:

- AASB 1056 Superannuation Entities and other applicable Australian Accounting Standards (AAS);

- the SISA and the SISR;

- ATO publications and guidelines;

- the Fund’s Trust Deed; and

- AASB 2020-2 Amendments to Australian Accounting Standards - Removal of Special Purpose Financial Statements for Certain For-Profit Private Sector Entities (March 2020) hereinafter referred to as AASB 2020-2.

Here are some practical considerations when accounting for crypto in SMSF, when preparing financial statements:

- Due to changes in March 2020 by the introduction of AASB 2020-2, where SMSF trust deeds that are created or amended on or after 1 July 2021; and require preparation of financial statements that comply with the AAS - the superfund will need to prepare GPFS in accordance with AASB 2020-2. If the trust deed refers specifically to accounting standards or AAS, then the fund must comply to the GPFS standard.

- Although, the majority of SMSF trust deeds refer to financial statements being prepared “in accordance with superannuation laws”, and therefore will not be immediately subject to AASB 2020-2 . If this is the case, the SMSF can continue to prepare Special Purpose Financial Statements (SPFS) which provides some flexibility on the disclosure requirements.

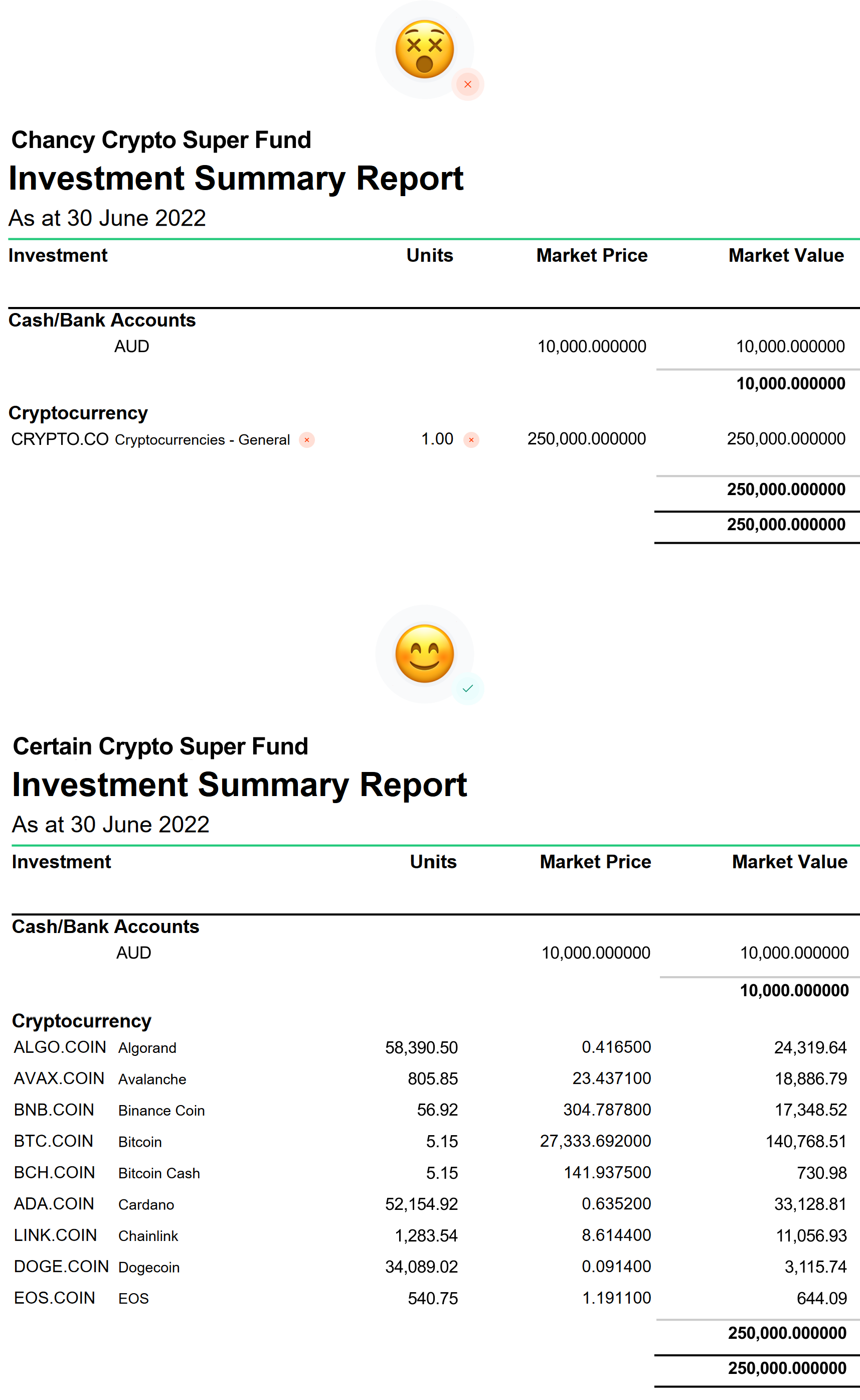

- All investment allocations must be presented clearly in the financial statements for the SMSF. There must be a breakdown of crypto assets, e.g. a total balance of BTC, total balance of ETH, and the market values. You cannot put a total quantity of crypto to reflect the whole portfolio. This is a requirement of AASB 101 Presentation of Financial Statements.

- The Investment reports must contain crypto, where each balance must be shown by asset including its quantity.

- It is important that the SMSF software used to prepare the SMSF financial statements reflects that crypto assets are an asset class in the fund. If the financial statements do not correctly show crypto in the final financial statements, this would be a breach of super rules.

- You are able to use BGL Super Fund 360 to generate financial statements, however, if crypto is in the superfund portfolio, then it must also be in BGL to flow into the final financial statements.

Audit requirements for crypto SMSF

The role of the SMSF auditor is to provide independent assurance that the SMSF's financial statements are accurate and comply with the relevant accounting standards and regulatory requirements.

The auditor must prepare an audit report that expresses an opinion on whether the financial statements give a true and fair view of the SMSF's financial position and performance.

Some of the key auditor requirements include:

- Audit of superfunds from the 1 July 2021 require an additional check by auditors on the appropriateness of the accounting framework adopted by the SMSF in light of AASB 2020-2.

- ASA 320 requires the auditor to consider performance materiality when determining the nature, timing and extent of financial audit procedures. When assessing the outcome of audit procedures, including the materiality of misstatements identified in the financial audit or contraventions identified in the compliance engagement, the auditor considers both their amount (quantitative) and nature (qualitative).

- Auditors have to confirm number of units which determine the value of the individual holding.

- Auditors have to examine investments for changes and movements and reconcile the schedules with purchase and sale transactions for the audit period to confirm that material movements in investments have been recorded.

- Auditor has the above requirements that can only be met if each transaction is recorded accordingly, e.g. synced into SMSF accounting software such as BGL.

Select crypto tax software built for SMSFs

As you know, the compliance for crypto SMSFs isn’t easy, that’s why it’s important to choose crypto tax software that has been designed specifically for Australian SMSFs, and not one that was built for individual taxpayers in a foreign country.

Syla is an Australian-only crypto tax software package, that has been designed specifically to handle crypto investments for SMSFs. That means all the quirks of crypto have been accounted for, to make life easier for Accountants 🙏

Syla has partnered with BGL to turn your past crypto accounting trauma, into transaction sync pleasure 😊

This article is part of our mega-guide on solving compliance for crypto SMSFs, the next article in the series is -> Checklist for onboarding a crypto SMSF